The Asian market is once again proving to be the heart of mobile gaming, with users spending an average of 19 minutes a day on apps by 2022, according to Adjoe and Statista.

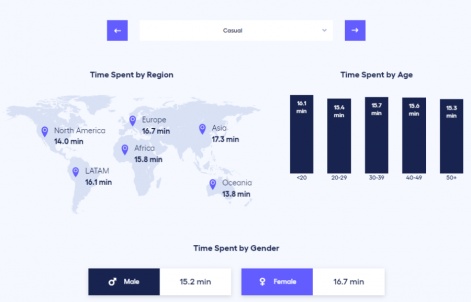

This is followed by Europe with 18.1 minutes and Africa with 17.3 minutes of gaming for logins. Players spend an average of 17.3 minutes on games in 2022, down 20% from 2021. This downward trend is evident across all regions and genres, where casual games have a limited time. Daily session volume fell 26%, the largest among any category. Asia proved to be central with 17.3 minutes, while casual players in Oceania spent just 13.8 minutes in the game.

Asia spends the most time playing games.

That has proved the game is the most popular application worldwide. The report also shows that female gamers spend an average of 20.7 minutes per day on the game. Male gamers are attracted to simulation and action titles, in both genres spending an average of 18.5 minutes in-game. This again shows the prevalence of gaming by gender. The adventure genre has the longest average session duration, followed by card games and action games. In contrast, casual, puzzle, and role-playing games had the lowest average session length.

In total, the mobile games market raked in $215.3 billion in revenue by 2022, according to Adjoe data. The bulk of this revenue ($145.3 billion, or 67.4%) came from in-app purchases, while $68.7 billion (31.7%) came from advertising revenue. The rest comes from paid apps. Adjoe predicts that the mobile games market will reach $352.1 billion by 2027, representing a compound annual growth rate (CAGR) of 12.2%.

RPG was identified as the most profitable genre in 2022, generating a whopping $63.23 billion in revenue worldwide. 64.3% ($40.7 billion) of this revenue came from in-app purchases, while another 35.4% ($22.4 billion) came from advertising, with the remainder coming from apps. use for a fee. In total, RPG accounts for about 30% of global mobile game revenue, and Adjoe estimates the genre will reach $98.67 billion by 2027 at a CAGR of 11.3%.

In contrast, word games are the least profitable genre as of 2022 at $2.41 billion, with an estimated valuation of $3.91 billion in 2027, corresponding to a CAGR is 10.8%. Card games generating $11.82 billion in 2022 are estimated to have the highest compound annual growth rate of all genres analyzed at 19.8%, reaching $22.43 billion in year 2027.

Asia proved to be the top mobile market in 2022, generating $121.7 billion in revenue. Followed by North America with $75 billion and Europe with $22.6 billion. The remaining regions analyzed were all significantly less profitable at $3.3 billion (Oceania), $2.5 billion (Latin America) and $0.3 billion (Africa). Each of these regions is forecast to grow over the next few years, however, the overall ranking remains the same in 2027. Asia is projected to generate $185.9 billion, followed by the Americas (122). $3.8 billion), Europe ($34.2 billion), Oceania ($4.8 billion) billion), Latin America ($3.8 billion) and Africa ($0.5 billion).

The market’s strong performance in Asia last year is particularly notable considering the turbulent 2022 China market with regulatory changes and new restrictions on game playtime. Young players are challenging the country’s position as the world’s largest mobile market. The growing reach and penetration of mobile games may have helped propel the continent’s market, especially as India has been identified as a potential competitor for the world’s top spot. .

RPGs proved particularly lucrative in Asia, generating $51 billion. In contrast, the US, the second most successful market for this category, grossed $8.8 billion. The genre’s strong performance can partly be attributed to some well-known releases in 2022, such as Diablo Immortal. Asia leads the way in terms of downloads, with 79.4 billion new installs by 2022. This is followed by Europe with 15.1 billion and North America with 12 billion. These strong rankings are expected to continue, with Asia forecast to reach 121.4 billion downloads by 2027, while Europe and North America are expected to hit 20.5 billion, respectively. billion and 16.3 billion downloads. Oceania has the lowest number of downloads in 2022, just 500 million, and is also predicted to have the lowest growth, reaching 700 million by 2027. Africa, the next small market, has 1.2 billion downloads by 2022 and is expected to reach 1.8 billion by 2027.